The descending triangle is a bearish formation that commonly varieties all through a downtrend as a continuation pattern. There are situations when descending triangles shape as reversal patterns at the stop of an uptrend, however they are normally continuation patterns. Regardless of the place they form, descending triangles are bearish patterns that point out distribution.

Oftentimes, merchants watch for a go beneath the support trend line due to the fact it suggests that the downward momentum is constructing and a breakdown is imminent. Once the breakdown occurs, traders enter into quick positions and aggressively assist push the charge of the asset even lower.

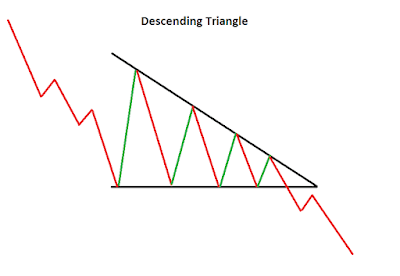

You’ve probably read it already: “What is Ascending Triangle Patterns Trading Analysis”, “Uses Support and Resistance for Trading Crypto”,“Crypto Pump and dump Schemes. Because of its shape, the sample can additionally be referred to as a right-angle triangle. Two or extra same lows shape a horizontal line at the bottom. Two or extra declining peaks structure a descending trend line above that converges with the horizontal line as it descends. If each strains have been prolonged right, the descending fashion line should act as the hypotenuse of a proper triangle. If a perpendicular line have been drawn extending up from the left give up of the horizontal line, a proper triangle would form.

- A descending triangle is a sign for merchants to take a short position to speed up a breakdown.

- A descending triangle is detectable by using drawing vogue traces for the highs and lows on a chart.

- A descending triangle is the counterpart of an ascending triangle, which is every other style line based totally chart sample used via technical analysts.

Let's observe every character phase of the sample and then seem to be at an example.

Trend: In order to qualify as a continuation pattern, an hooked up style must exist. However, due to the fact the descending triangle is honestly a bearish pattern, the size and length of the modern style is now not as necessary as the robustness of the formation.

Lower Horizontal Line: At least two response lows are required to structure the decrease horizontal line. The lows do no longer have to be exact, however must be inside practical proximity of every other. There ought to be some distance setting apart the lows and a response excessive between them.

Upper Descending Trend Line: At least two response highs are required to structure the top descending style line. These response highs have to be successively decrease and there need to be some distance between the highs. If a greater latest response excessive is equal to or larger than the preceding response high, then the descending triangle is no longer valid.

Duration: The size of the sample can vary from a few weeks to many months, with the common sample lasting from 1-3 months.

Volume: As the sample develops, extent normally contracts. When the draw back smash occurs, there would ideally be an growth of extent for confirmation. While quantity affirmation is preferred, it is no longer usually necessary.

Return to Breakout: A simple tenet of technical evaluation is that damaged guide turns into resistance and vice versa. When the horizontal help line of the descending triangle is broken, it turns into resistance. Sometimes there will be a return to this newfound resistance stage earlier than the down go starts offevolved in earnest.

Target: Once the breakout has occurred, the fee projection is located by using measuring the widest distance of the sample and subtracting it from the resistance breakout.

Read To : What Is Volume in Cryptocurrency trade?

Benefits of Using Cryptocurrency in your Business For Long Term

In distinction to the symmetrical triangle, a descending triangle has a precise bearish bias earlier than the proper break. The symmetrical triangle is a impartial formation that depends on the impending breakout to dictate the route of the subsequent move. For the descending triangle, the horizontal line represents demand that prevents the safety from declining previous a positive level. It is as if a massive purchase order has been positioned at this stage and it is taking a range of weeks or months to execute, for this reason preventing the charge from declining further. Even even though the rate does now not decline previous this level, the response highs proceed to decline. It is these decrease highs that point out accelerated promoting strain and provide the descending triangle its bearish bias.

The Limitations of Using a Descending Triangle

The difficulty of triangles is the plausible for a false breakdown. There are even conditions the place the fashion strains will want to be redrawn as the charge motion breaks out in the contrary course - no chart sample is perfect. If a breakdown does not occur, the inventory may want to rebound to re-test the top fashion line resistance earlier than making any other cross decrease to re-test decrease style line aid levels. The greater instances that the fee touches the aid and resistance levels, the greater dependable the chart pattern.

Post a Comment